Planning a trip to Sri Lanka from the UK involves more than booking flights and hotels – you also need to prepare for handling money on the ground.

This travel guide provides up-to-date advice on currency exchange, using your British Pounds (GBP) in Sri Lanka, and financial tips to make the most of your money.

Dilshan

DilshanWe’ll cover where to get the best exchange rates, how airport exchanges compare to city options, which UK-based services (like Travelex, the Post Office, Revolut, and Wise) can help, tools for tracking exchange rates, and essential travel insurance considerations.

By understanding the Sri Lankan currency and banking landscape, UK travellers can avoid unnecessary fees and travel with confidence.

Sri Lankan Currency Overview

The official currency of Sri Lanka is the Sri Lankan Rupee (LKR), often abbreviated as Rs. Banknotes come in denominations up to Rs 5,000 (with smaller notes of Rs 2,000, 1,000, 500, 100, etc.), and coins range from Rs 1 to Rs 10.

For context, £1 GBP is roughly around LKR 400 in late 2025 (exchange rates fluctuate, so check current rates before you travel). Importantly, the Sri Lankan Rupee is a “closed” currency, meaning it’s not widely traded or available outside Sri Lanka.

In fact, it is virtually impossible to buy LKR in the UK at a decent rate, and Sri Lankan law caps the amount of local currency you can bring in or take out (currently only LKR 20,000, which is about £50).

This means UK travellers should plan on obtaining most of their Sri Lankan money after arriving in Sri Lanka, rather than before departure.

Despite being closed, the Sri Lankan Rupee is easy to obtain once you’re in Sri Lanka. Major foreign currencies – including British Pounds – are widely accepted for exchange by banks and licensed money changers.

In other words, you can bring GBP cash with you and convert it to LKR in Sri Lanka without trouble.

There’s no need to convert GBP to USD or another currency first – sterling is recognized and exchangeable at banks and forex counters in Sri Lanka.

The key is to know where and how to exchange your money to get a fair rate, which we’ll explore next.

Exchanging British Pounds (GBP) to LKR in Sri Lanka

Your best value will usually come from exchanging money in Sri Lanka, not in the UK.

Exchange rates offered in Britain for Sri Lankan Rupees tend to be much less favorable than rates within Sri Lanka. Since LKR isn’t commonly stocked in UK bureaus, any place that does offer it often adds a hefty markup.

Many experienced travellers therefore simply carry GBP in cash and swap it for rupees after landing in Sri Lanka.

Sterling notes are accepted at bank exchange counters and authorized forex booths in Sri Lanka’s airports and cities.

These official exchange services use the day’s prevailing rates and do not charge additional commissions, so the rate you see is the rate you get (minus a small margin).

Another convenient option is to withdraw LKR from ATMs in Sri Lanka using a debit card.

This can actually yield a good exchange rate close to the interbank rate, especially if your UK bank or card has low foreign transaction fees.

Many UK travellers use travel-friendly debit cards (like Monzo, Starling or Metro Bank) or fintech services (like Revolut or Wise) to withdraw cash in local currency at ATMs for a minimal fee.

If you plan to rely on ATMs, notify your bank before travel and check what fees or daily limits apply.

Also prefer ATMs of major Sri Lankan banks (such as Bank of Ceylon, Commercial Bank, Sampath Bank, etc.) and those located inside bank branches for safety – this helps avoid ATM skimmers or fraud at standalone machines.

How much cash to exchange?

It’s a good idea to exchange a small amount of cash on arrival (either at the airport or via ATM) to cover immediate expenses like transport from the airport, tips, or a meal.

Afterwards, you can exchange larger amounts in town as needed, once you’ve compared rates. Sri Lanka is still a cash-centric country for many transactions, especially at local shops, markets, and smaller hotels.

Ensure the bills you bring to exchange (GBP notes) are in good condition (untorn, not overly old), as exchange counters may be picky about accepting damaged foreign notes.

You’ll need your passport when exchanging money at a bank or authorized changer, and you should keep the exchange receipt if you think you might convert any leftover rupees back to pounds when leaving Sri Lanka.

Airport vs. City Currency Exchange: Pros & Cons

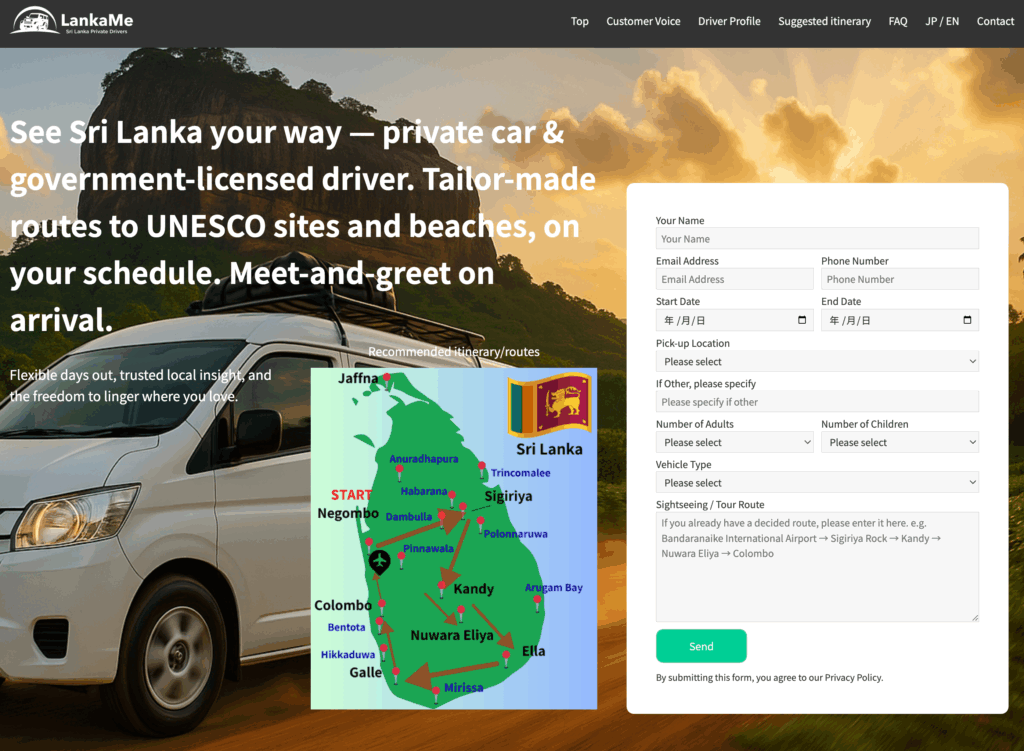

When you arrive at Bandaranaike International Airport (Colombo), you will find several bank-run currency exchange counters in the arrivals hall that operate 24/7 for travellers.

These include branches of major banks like Sampath Bank, People’s Bank, Commercial Bank, Bank of Ceylon, etc., as well as possibly a Thomas Cook exchange booth.

Exchanging money at the airport is extremely convenient – you can get local cash as soon as you land, at any time of day or night, in a safe and official environment.

The exchange rates at the airport are official and regulated, but they may be slightly lower (less favorable) than the rates you might find at banks or money changers in Colombo city.

For example, if a city bank offers 405 LKR per GBP, the airport counter might offer a bit less. This “airport premium” is the price of convenience, but the difference is usually only a few percentage points.

- Airport Exchange – Advantages: You get cash in hand immediately upon arrival, which is useful for paying your taxi or buying a SIM card, etc. The airport counters are open 24/7 and run by reputable banks, so security and reliability are high. There’s no commission fee. If you arrive late at night, the airport counters ensure you’re not stuck without local money.

- Airport Exchange – Disadvantages: The rate, while fair, can be a bit inferior to city rates. You might get fewer rupees per pound compared to exchanging in town. Also, because you’re likely tired and unfamiliar with the rates upon arrival, you have less flexibility to shop around. The difference isn’t huge, but if exchanging a large sum (hundreds of pounds), even a 2-3% difference adds up. Therefore, some travellers exchange only a small amount at the airport (for immediate needs) and wait to exchange the bulk in the city for a possibly better rate.

In Colombo and other tourist hubs (like Negombo, Kandy, Galle, or Jaffna), you will find many authorized money changers and bank branches that offer currency exchange.

Often, major banks have dedicated forex counters, and licensed money exchange shops operate in markets or shopping areas. City exchanges often offer very competitive rates, sometimes slightly better than the airport.

The advantage in the city is that you can compare rates among a few shops or banks which may let you squeeze out a better deal.

Additionally, if you’re exchanging money after a few days into your trip, you’ll have a sense of the approximate rate (from news or apps) and can recognize a good rate when you see one.

Always use authorized dealers – look for ones with a license displayed, or stick to well-known banks. Avoid any unofficial street money changers who approach you with enticing rates, as they could be scams or give counterfeit notes.

- City Exchange – Advantages: Potentially better exchange rates than the airport (especially for larger amounts), and the ability to shop around. In cities like Colombo, the difference might be modest but noticeable over a large sum. Authorized money changers are plentiful, and hotels in cities can also exchange money (though hotel rates are usually a bit worse than banks). If you have time, you can check the daily rate at two or three places and choose the best offer.

- City Exchange – Disadvantages: Unlike the airport, city banks and exchange bureaus have limited hours (most banks operate roughly 9:00 AM to 3:00 PM on weekdays). Independent exchange shops may stay open later, but you won’t find many open late at night. It requires planning to get to a bank during the day. Also, you must ensure the exchanger is official and trustworthy. Stick to exchanges recommended in guidebooks or forums, or those inside reputable establishments. And remember to carry your passport when exchanging at banks. Security is generally good, but normal precautions apply: put your cash away discreetly after the transaction.

In summary, exchanging at the airport is excellent for convenience and immediate needs, whereas exchanging in the city might give you a slight edge on rate for larger sums.

Many travellers use a mix of both: e.g. exchange £50-£100 at the airport to start, then do further exchanges in town as needed.

No matter where you exchange, always count your rupees and get a receipt. Sri Lanka’s exchange services are generally honest, but it’s wise to double-check the amount and keep the receipt (it will be needed if you want to convert rupees back to GBP later).

ATMs and bank currency exchange counters at Colombo Bandaranaike International Airport. Major Sri Lankan banks operate 24/7 kiosks for arriving passengers, offering a convenient way to get local currency immediately upon arrival.

Using ATMs and Cards in Sri Lanka

In addition to cash exchanges, ATMs are widely available in Sri Lanka’s cities and large towns, giving another way to obtain Sri Lankan Rupees.

Visa, Mastercard, and Cirrus/Maestro debit cards from the UK are accepted at most major bank ATMs (look for signs for Visa or Mastercard at the ATM).

When you use a foreign card at a Sri Lankan ATM, you’ll get money in LKR dispensed at the bank’s exchange rate (usually very close to the official rate).

This can be a very convenient option – for instance, you might withdraw Rs20,000 and your UK bank will deduct whatever that equates to (around £50) plus any fees.

Do note: many Sri Lankan ATMs have a per-withdrawal limit (often around Rs 40,000 to Rs 100,000, depending on the bank), so you might need to make multiple withdrawals if you need a lot of cash (and be mindful of your own bank’s daily withdrawal limits too).

Your home bank in the UK may also charge an international withdrawal fee or percentage.

To minimize costs, consider using a UK card that has no foreign ATM fees (some UK-based travel debit cards and fintech services like Monzo, Revolut, Starling, or Wise have low or zero fees abroad).

These cards often use the MasterCard or Visa exchange rate with no added commission, meaning you get very close to the true market rate.

For example, Revolut and Wise offer cards linked to multi-currency accounts: you can preload GBP and withdraw LKR or let the card auto-convert at the time of purchase at the real exchange rate with minimal markup. Just beware that some of these services have limits (e.g. a cap on fee-free ATM withdrawals per month) and may apply a small surcharge on weekends.

Credit cards (Visa, Mastercard, and to a lesser extent Amex) are accepted at mid-range and high-end hotels, shops, and restaurants in tourist areas and cities.

However, cash is king in local establishments – if you’re shopping at markets, paying tuk-tuk drivers, or dining in small family-run eateries, you will need cash in rupees.

Plan to use cards for larger expenses (hotel bills, fine dining, major souvenir shops) and cash for day-to-day small purchases. When using a card in Sri Lanka, always choose to be charged in Sri Lankan Rupees, not GBP, if given the option.

Some card terminals or ATMs will offer a “GBP” charge or show you an amount in GBP – this is dynamic currency conversion, which almost always works against you with a poor rate. Decline that and insist on paying in LKR; your own bank will do the conversion at a better rate.

Finally, exercise standard precautions: use ATMs in well-lit, secure locations, preferably attached to a bank.

In fact, a good tip is to go inside a bank during working hours and use the ATM in the lobby – if there’s any issue (card gets stuck, etc.), you can get help. Shield your PIN, and monitor your bank statements or app for any fraudulent charges (rare, but it’s good practice whenever traveling).

By using a combination of cash exchanges and card withdrawals/payments, you can ensure you always have access to funds at a reasonable exchange rate throughout your Sri Lanka trip.

UK-Based Currency Exchange Options Before Travel

Since the Sri Lankan Rupee is a closed currency, you won’t find it as commonly available in UK high street banks as, say, euros or US dollars.

However, some UK currency exchange providers do stock LKR – for example, the Post Office, Travelex, or specialized travel money bureaus (even certain supermarkets like Morrisons or M&S Travel Money) allow you to pre-order Sri Lankan rupees.

If you’re determined to get some rupees in hand before flying, you could order from one of these providers, but be aware of the trade-offs.

The exchange rate for LKR in the UK will almost certainly be worse than what you’d get in Sri Lanka.

These providers know rupees are hard to get, so they apply a bigger margin. There may also be minimum order amounts or delivery fees (for example, Post Office online orders often have a £400 minimum for better rates).

Recommendation: If you really want a small amount of local cash for peace of mind on arrival, you could exchange a bit of GBP to LKR in the UK (say £50–£100 worth) knowing you’re paying a premium for convenience.

Otherwise, it’s generally more cost-effective to carry GBP and exchange in Sri Lanka or use an ATM on arrival Another alternative is to bring a universally accepted currency like US dollars – while GBP is readily exchangeable in Sri Lanka, some travellers bring a backup stash of USD (or EUR) in cash as well, since USD can sometimes be handy in emergencies or at certain tourist shops.

But for most UK travellers, sterling cash plus a good debit/credit card will suffice.

Let’s look at a few UK-based exchange options and how they fit into Sri Lanka travel plans:

- Travelex: Travelex allows you to order currencies online for pickup at airports or city branches. They do offer Sri Lankan Rupees, though rates can be quite poor. One convenience is you can pick up LKR at Heathrow or other departure airports, but double-check the rate. Sometimes Travelex at UK airports gives around 10-15% less LKR per pound than you’d get at Colombo Airport – a significant difference. Travelex has no commission (the profit is in the rate). Use this only for a small starter amount if needed.

- Post Office Travel Money: The Post Office is a popular choice for UK travellers because of its extensive network and competitive rates for mainstream currencies. They list over 60 currencies available to order, and LKR is often on the menu (sometimes for branch collection, possibly not all branches). The Post Office tends to have slightly better rates than airport money changers in the UK and no commission. You can order online and collect at a larger branch. Again, compare their online rate to the mid-market – you might find, for example, they offer something like LKR 350 for £1 when the real market rate is around LKR 400 (just an illustrative example). That gap is the cost of buying currency in the UK.

- Banks and Other Bureaux: A few UK banks might get you LKR if you request (often by ordering through their systems), but many don’t keep exotic currencies readily available. Specialized bureaux like eurochange or M&S Bank might have LKR or can order it with a day or two notice. Always ask about any fees and compare rates. Remember, you can also sell back any unused LKR after your trip at these places, but they might only buy back small amounts due to the currency’s restrictions. Keep your receipts from Sri Lanka if you plan to reconvert – it might help prove the legitimacy of the funds.

- Revolut & Wise (Digital Options): Rather than buying a pile of foreign cash, consider using fintech services. Revolut and Wise (formerly TransferWise) are two UK-based services that offer multi-currency accounts and cards. With Revolut, for example, you can hold your money in GBP and convert to LKR within the app at the interbank rate (Revolut supports LKR for spending, though check if you can hold a balance in LKR – it may simply convert on the fly when you spend or withdraw in Sri Lanka). Wise similarly lets you convert GBP to LKR at the real mid-market rate with a small transparent fee, and you can then spend directly in LKR using the Wise debit card, or withdraw cash at an ATM. These digital options often give much better rates than cash exchanges, because their rates are near the true market rate. The benefit is also safety – you carry less cash and can cancel the card if lost. Just be mindful of any ATM withdrawal limits on these cards (for instance, Wise allows a certain amount fee-free, after which a small percentage fee applies; Revolut standard users have a monthly free withdrawal limit around £200). Overall, Revolut and Wise are highly recommended for savvy travellers – they have become top choices for currency on the go. Even if you prefer cash, having one of these as a backup means you always have a way to pay or get money in an emergency.

In summary, UK-based exchanges can be used for a small amount of Sri Lankan Rupees before your trip if you feel you need it.

But given the significantly better rates on offer in Sri Lanka, most of your currency exchange should be done after you arrive.

With modern banking options like travel cards and fintech apps, many UK travellers now forgo buying foreign cash in advance at all, instead relying on ATM withdrawals and card payments upon arrival for a better overall rate and more security.

Tips for Getting the Best Exchange Rate

To maximize the value of your money, keep in mind the following tips and best practices for currency exchange and spending in Sri Lanka:

- Avoid exchanging large sums at airports if possible: Airport exchange counters are convenient but typically offer slightly weaker rates than city exchanges. Change just enough at the airport for immediate needs (taxi, etc.), and do larger exchanges in town where rates are a bit better.

- Use banks or licensed money changers, and avoid street deals: Stick to official exchange points – they give competitive rates and honest service. Unofficial street money-changers might promise high rates but could scam you with counterfeit notes or bad math. It’s not worth the risk.

- Compare rates and bargain if appropriate: In some independent exchange shops, the posted rate might be negotiable if you’re changing a lot. Don’t be afraid to ask “Is that the best you can offer for £XXX?” Sometimes, showing you know the market rate (thanks to your XE app) might prompt a slightly improved quote. If not, shop around – even a difference of 2% is meaningful on big amounts.

- Beware of additional fees: Ensure that no extra commissions are charged. In Sri Lanka, most exchanges give a net rate (no commission). If anyone tries to add a fee, you’re likely better off going elsewhere. Also, when withdrawing from ATMs, use banks that don’t surcharge if you can find them, or factor the ATM fee into how much you take out (withdraw larger amounts less frequently to reduce the impact of fixed fees).

- Use credit cards with no foreign transaction fees for larger purchases: If you have a credit card that doesn’t charge the typical 3% foreign fee (for example, certain UK cards like Halifax Clarity or Barclaycard Rewards), use it for big expenses like hotel bills or pricey restaurant meals. You’ll get a near-perfect exchange rate and build purchase protection. Just ensure you can pay it off to avoid interest.

- Stick to weekday rate conversions for large transfers: International currency markets close on weekends, and some services (including banks and apps like Revolut) apply a markup or less favorable rate from Friday evening to Monday morning to mitigate risk. If you are converting a substantial amount via an app or deciding when to exchange, doing so on a weekday when markets are active can sometimes fetch a slightly better rate. (This is a minor point, but every little helps!).

- Decline dynamic currency conversion (DCC): As mentioned earlier, if a payment terminal or ATM offers to charge your card in GBP rather than LKR, always refuse. DCC transactions often have very poor rates or hidden fees. Pay in the local currency (LKR) and let your bank handle the conversion for the best rate.

- Keep exchange receipts and don’t over-exchange: Try not to exchange far more cash than you’ll need, since you’ll have to change it back to GBP later (and you’ll lose on the spread twice). It’s better to exchange in smaller chunks as needed. If you do end up with a lot of leftover rupees, you can convert them back to a major currency at the airport when departing – but you must show the original exchange receipts to do so legally (this is because of currency control regulations). Without receipts, they might refuse to change back large amounts of LKR. So, save those slips.

- Stay updated and flexible: Economic situations can change. While this guide reflects late 2025 conditions, keep an eye on Sri Lanka news. For instance, if there were to be any government restrictions on currency (as happened during the 2022 crisis), you’d want to adjust strategies (like relying more on USD or cards). Checking the UK Foreign Office travel advice before departure is always wise for any currency or financial notices.

By following these tips – comparing rates, using the right cards and tools, and avoiding common pitfalls – you’ll stretch your travel money further.

A little preparation can save you a significant sum on exchange costs, which means more budget for enjoying Sri Lanka!

Travel Insurance Considerations for Sri Lanka

Lastly, but critically, ensure you have comprehensive travel insurance for your trip to Sri Lanka.

Many UK travellers might already know the importance of travel insurance, but it’s worth emphasizing for Sri Lanka because you will be far from home and unexpected incidents can be costly.

Here are key insurance points to consider:

Medical and Emergency Coverage

At minimum, your insurance should cover emergency medical treatment and hospitalization, including any hospital stays, doctor’s fees, and medication.

Hospitals in Sri Lanka may require payment up front if you don’t have insurance, and serious medical evacuations (air ambulance to the UK or a nearby country) can cost tens of thousands of pounds.

Make sure the policy’s medical coverage limit is sufficiently high (many policies offer £5 million or more, which is standard to cover worst-case scenarios globally).

It should also include repatriation – the cost of flying you back to the UK for medical reasons if needed. We hope you’ll never need this, but it’s vital protection. Without insurance, you would be personally liable for all these costs, which could be financially devastating.

COVID-19 and Health Conditions

As of 2025, COVID-19 is less disruptive than before, but check if the policy covers COVID-related cancellations or treatment abroad, just in case.

Also, declare any pre-existing health conditions when buying the policy. If you have any condition (even something like asthma or diabetes), ensure the insurer knows – otherwise they might refuse related claims.

The UK’s FCDO travel insurance guidance advises that all existing conditions be covered to avoid invalidating the policy.

Trip Cancellation and Curtailment

Good travel insurance will cover you if you have to cancel your trip or cut it short due to certain unforeseen events – for example, illness (you or a close family member), a death in the family, or other emergencies.

This cancellation cover should reimburse your non-refundable costs (flights, hotel bookings, tours, etc.) up to a certain amount if you have to cancel before departure, or the unused portion plus any extra costs to get home if you have to curtail the trip part-way through.

When purchasing insurance, verify the cancellation cover limit at least equals the total cost of your prepaid trip arrangements. Buy the insurance as soon as you book your trip so that this protection is in effect; don’t wait until the day before you leave.

Lost, Stolen or Delayed Baggage and Belongings

Travel insurance typically includes coverage for your personal belongings.

This means if your checked luggage gets lost or delayed by the airline, you can claim for essentials to buy clothes and toiletries, etc., and possibly a lump sum if the bag is permanently lost.

If your bags or valuables are stolen or damaged during the trip, that’s also covered (usually up to certain item limits). Keep receipts for any expensive items you’re bringing (camera, laptop) as proof of value if you needed to claim.

Note that cash is often only covered up to a low limit (e.g. £200), so don’t carry more cash than necessary or consider using a hotel safe. And be aware of the single-item limits – for example, a £1500 laptop might only be covered up to £500 unless you bought extra cover.

Adventure Activities and Special Sports

Think about what you plan to do in Sri Lanka. Standard travel policies typically cover common activities (city tours, hiking, safari rides to an extent, etc.), but if you plan on doing scuba diving, surfing, hot-air ballooning, trekking above certain altitudes, or any “risky” activity, check if it’s covered or if you need to add an extra premium for it.

Sri Lanka has surf spots and diving sites; some basic policies exclude those. Always read the sports and activities section of your policy to ensure all your planned adventures are included, or upgrade the policy if needed.

Policy Excess and Emergency Contacts

Check the excess (deductible) you’d have to pay on claims – often you can choose this when buying (a higher excess usually lowers the premium, but make sure it’s an amount you could comfortably pay out-of-pocket for a claim).

Carry the insurance emergency contact number and your policy number with you (store it in your phone and keep a printout).

In case of any serious incident, you or a companion should contact the insurer’s emergency helpline promptly – they can usually coordinate payments or evacuation if needed, provided you inform them timely.

A good travel insurance policy gives peace of mind.

The UK government strongly advises not to travel without insurance, because if something goes wrong, you’re responsible for covering costs and the British High Commission in Colombo will not pay these for you.

Medical situations, in particular, can be extremely expensive abroad. Beyond money, insurance often comes with assistance services – e.g. they can help locate English-speaking doctors or arrange logistics in an emergency, which is invaluable in a stressful situation.

In summary, don’t skimp on travel insurance for Sri Lanka. Ensure it covers medical emergencies (including evacuation), lost or delayed baggage, trip cancellation, and any special activities you plan. With that in place, you can explore Sri Lanka knowing you’re protected against the unexpected.

Conclusion

With the right preparation, managing your money in Sri Lanka is straightforward.

Remember to get your Sri Lankan rupees through the best channels (ideally in-country at banks or ATMs for a good rate), use technology and travel-friendly cards to your advantage, and keep your money and documents safe.

By following the guidance above, UK travellers can enjoy their Sri Lankan adventure with confidence – avoiding common money hassles and focusing on the amazing experiences, from stunning beaches and tea plantations to cultural treasures. Safe travels, and enjoy Sri Lanka!

コメント